Justus Inhoffen

Ph.D. Student

- DIW Berlin

- Vrije Universiteit Amsterdam

- De Nederlandsche Bank

Research

Interests

- Capital Markets

- Financial Stability

- Machine Learning

Publications

- Minimum prices and social interactions: Evidence from the German renewable energy program

- Energy Economics, 78, pp 350-364, 2019

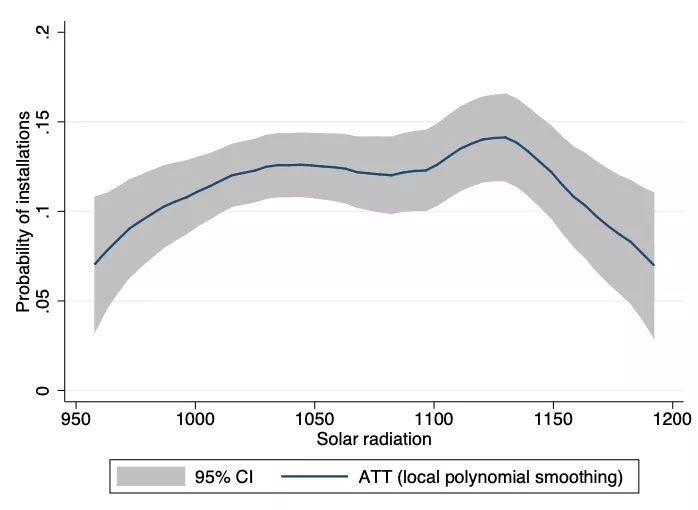

Minimum prices above the competitive level can lead to allocative inefficiencies. We investigate whether this effect is more pronounced when decision makers are influenced by their social environment. Using data of minimum prices for renewable energy production in Germany, we test if individual decisions to install photovoltaic systems are affected by the investment decisions of others in the area. We implement a propensity score matching routine on municipality level and estimate that existing panels in the municipality increase the probability and number of further installations considerably, even in areas with minimal solar radiation. Thus, social interaction can add secondary inefficiencies to the known allocative problems of minimum prices. The social interaction effect is stronger in areas with more solar radiation and less unemployment. A larger number of existing systems and more concentrated installations increase the social effect further.

Working Papers

- Crowding of International Mutual Funds

- Revise & Resubmit at Journal of Banking & Finance

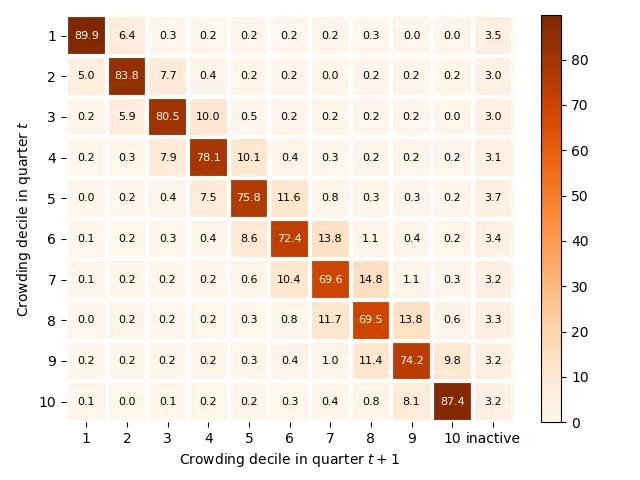

We study the relationship between crowding and performance in the active mutual fund industry. Using the equity holdings overlap of 17,364 global funds, we find that funds that crowd into the same stocks underperform passive benchmark funds by 1.4% per year. The negative returns to crowding can at least in part be explained by excess demand for liquidity and the associated discount for holding liquid stocks. We show that our measure of crowding contains novel information about performance that is not reflected in other variables that describe funds' investment environment, such as fund size and style. Our findings suggest that crowding of investment opportunities is important for understanding diminishing returns.

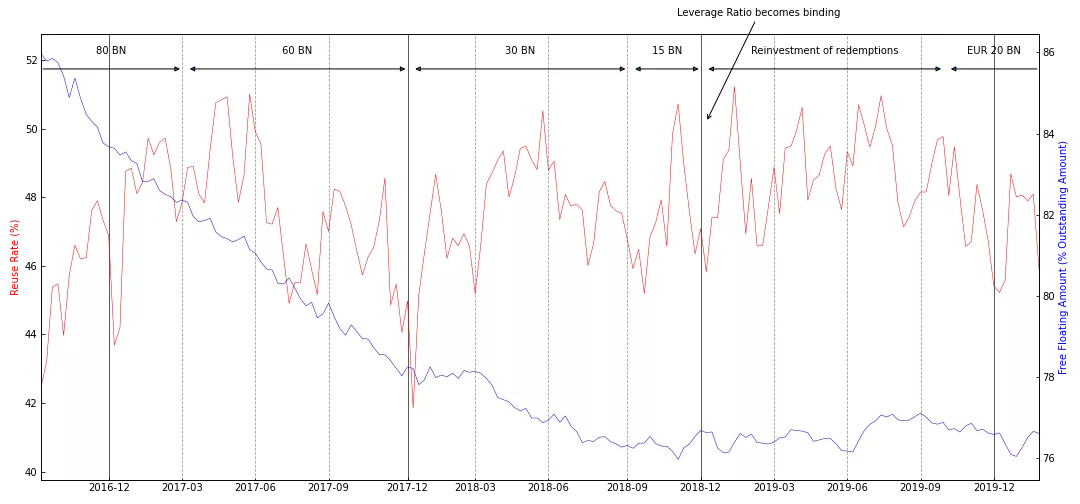

We construct the first measure of collateral re-use at the bank and bond level for the European repo market using a regulatory transaction dataset. We show that banks materially increase the rate of re-use in response to tightened asset scarcity induced by the Eurosystem's asset purchase program. We find that dealers accommodate clients' demand for safe assets rather than liquidity and profit from the repo rate spread. Yet, dealers also re-use collateral to source liquidity which exposes them to collateral runs. Our results contribute to the policy debate on trade-offs between shock absorption and financial stability risks of collateral re-use.

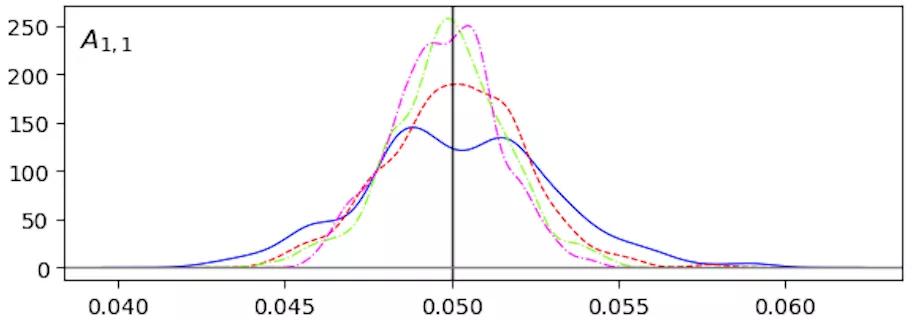

- Risk Spillovers in the Eurozone Financial Sectors

- Coming Soon

Policy Articles

- Low for Long: Side Effects of Negative Interest Rates

with Atanas Pekanov, Thomas Url

European Parliament, Directorate-General for Internal Policies of the Union, 2021. - Financial stability: New, detailed datasets allow for innovation of stress tests

with Iman van Lelyveld

DIW Weekly Report, 2020. - Indirect Interconnectedness - Portfolio Overlap in the Euro Area

with Nick Bootsma, Peter Wierts, Iman van Lelyveld

Global Monitoring Report on Non-Bank Financial Intermediation 2018, pp. 36-38, 2019. - Stability implications of financial interconnectedness under the Capital Markets Union

DIW Roundup: Politik im Fokus, pp. 129, 2019.